Foreign investors benefit from investing in Dubai’s real estate market. These include high standards of living, security, atmosphere, and top-class education, and most importantly, there is no property tax. Keep reading this article to learn about the benefits of property tax in Dubai and major investment areas.

1. No Property Tax

One of the giant benefits for foreign traders in Dubai is the absence of an annual belongings tax. In many other international locations, belongings owners should pay a recurring tax primarily based on the fees in their properties.

However, there may be no such tax on property in Dubai, which means that buyers can experience the blessings of property investment without stressing about the sizeable annual loss of a property tax. This appreciably enhances coin float, as traders can maintain more of the profits generated from condo houses. This freedom allows for reinvestment into additional houses or other investment opportunities, developing a sustainable cycle of wealth creation.

2. No Capital Gains Tax

Dubai’s tax legal guidelines are designed to incentivize investments by casting off capital profits tax. This way, when overseas buyers sell their properties, they can maintain their earnings while not paying a percentage to the authorities. This policy is mainly attractive for lengthy-time period traders looking to realize the entire fee of their belongings, as property prices in Dubai can be recognized notably through the years.

3. No Inheritance Tax

Inheritance tax can be a significant monetary burden in many world components, but Dubai’s legal guidelines are extra investor-friendly. The emirate does not impose an inheritance tax, meaning foreign asset owners can pass their properties in Dubai on to heirs without incurring extra monetary liabilities.

This is particularly critical for expatriates and global traders because it guarantees that wealth may be transferred smoothly throughout generations, assisting in holding the circle of relatives legacies without a load of taxation.

4. No Rental Income Tax

Dubai has an extensive tax advantage for those looking to generate income through condominium houses: no condo profits tax. In many nations, landlords must pay taxes on their condo profits. However, in Dubai, asset proprietors hold a hundred in their apartment income, making the marketplace even more attractive. This benefit permits buyers to set competitive rental charges whilst maximizing their returns.

5. Freehold Ownership for Foreigners

Another key gain for foreign buyers when they invest in properties in Dubai, like Mercedes Benz Places Dubai is the policy of allowing non-residents to own belongings in certain regions. Dubai has unique “freehold” regions where overseas nationals should buy property with full possession rights, granting them lengthy-term safety over their investments. This is a rare privilege in many nations, wherein overseas possession of actual property is regularly confined.

6. Exemptions for Foreign Business Owners

Dubai gives additional blessings for foreign buyers seeking to combine real estate possession with business activities. The city’s diverse loose zones offer tax exemptions for corporations, such as exemptions from company taxes, import duties, and other expenses. This setup encourages entrepreneurship and allows foreign investors to apply their houses as a base for establishing groups.

7. Economic Stability and Growth

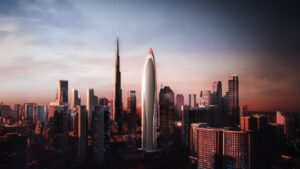

Dubai’s economy is characterized by stable and developing business surroundings. With ongoing infrastructure improvement, a strategic place such as Mercedes Benz Places Binghatti, and a thriving tourism sector, Dubai offers a variety of investment opportunities beyond the actual property. The absence of belonging taxes and other investor-pleasant policies contributes to the town’s beauty as a global hub for business and funding.

8. Strong Legal Framework for Property Transactions

Dubai’s criminal machine is transparent and robust, offering foreign investors the self-belief to spend money on real estate without concern about unfair practices. The Dubai Land Department (DLD) regulates real estate transactions, ensuring that consumers and dealers are treated fairly and that property rights are upheld.

The felony safety provided to overseas traders makes Dubai a steady environment for real estate investments, offering peace of mind and financial benefits.

9. Future Prospects for Growth

Dubai’s real estate market remains one of the fastest-developing in the world, with high demand for residential and industrial homes in Mercedes tower. The upcoming tendencies, consisting of massive-scale projects like Expo 2020, the Dubai Creek Tower, and the growth of the town’s infrastructure, are predicted to similarly boost property values in the coming years.

In the End

Property tax in Dubai regulations, including the absence of assets, capital profits, inheritance, and apartment income taxes, make it one of the most appealing real estate markets for foreign investors. The lack of habitual tax liabilities, mixed with the ability to own assets as a foreigner, ensures that investors can maximize their returns on funding.

The town’s persistent growth, stable financial environment, and investor-pleasant legal guidelines and rules create a promising landscape for real estate investments. Dubai offers foreign traders a remarkable opportunity to revel in tax-loose blessings while capitalizing on the city’s booming asset marketplace.